In today’s quickly-paced planet, technology has significantly converted the way you perform economic purchases. Just about the most efficient options for organizations to obtain monthly payments from customers is by Automated Eradicating Property (ACH) deals. ACH payments are digital exchanges of capital between accounts, plus they have become more popular then ever in recent years because of the speed, protection, and price-effectiveness. With this article, we’ll discover ACH payment services in greater detail, analyzing the way they job, what rewards they feature, and exactly how companies can put into practice them inside their settlement functions.

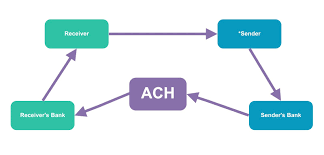

ach payment services are electronic transfers of funds between accounts, which typically entail either a customer or perhaps a enterprise mailing money to another one enterprise or dealer. The procedure of an ACH repayment services are initiated by the sender of the transaction, who produces an ACH document that describes the repayment information, such as the sum, the receiver, and also other related information and facts. Once the file is finished, it is published to the obtaining financial institution, which verifies the details and sends the funds towards the recipient’s profile. This complete procedure normally takes a person to three business days, which happens to be much faster than classic pieces of paper checks.

One of the more considerable benefits of ACH payment services is the expense-usefulness they have. When compared with a credit card, transactions costs tend to be reduced, which makes it an excellent option for small enterprises and business owners that want to save money on repayment processing charges. Additionally, ACH purchases give a reduced probability of fraud, as they call for specific details through the sender, which includes checking account and routing numbers.

An additional benefit of ACH payment services is simply because they can be fully automated, allowing you to streamline your transaction processes and enhance your business’s effectiveness. Rather than physically generating and mailing document checks or handling bank card monthly payments, you are able to setup ACH repayments to get automatically packaged with a routine that works the best for your small business. This means you can give attention to much more essential elements of your business, like customer satisfaction, marketing, or product or service improvement.

Implementing ACH payment services into your enterprise is relatively uncomplicated. To get going, you’ll have to produce your account with the ACH company, like PayPal or Stripe. As soon as you’ve recognized your money, you’ll must link it with your bank account to allow electrical moves. After that you can integrate your ACH repayment services software program with the present transaction method, and you’re good to go.

Finally, ACH obligations are becoming increasingly popular among clients who need smooth purchases. Firms that offer ACH obligations as an choice will likely see a rise in consumer preservation and pleasure, which can lead to increased sales and earnings. Buyers take pleasure in the safety and rate of ACH payments, and a lot of like them over papers assessments or a credit card.

simple:

In summary, ACH payment services will help companies improve their repayment functions, cut costs, and increase customer care. By comprehending the benefits of ACH monthly payments, companies can far better get around the changing fiscal panorama and satisfy the needs of the buyers. Whether you’re an businessperson only starting out or even a well-set up organization looking to improve your settlement digesting, ACH payment services are a fantastic choice to take into account. Be sure to investigation various ACH providers and look for one that very best suits you, and relish the great things about effortless deals.